What Does Retail Space For Lease Mean?

Some Ideas on Retail Space For Lease You Should Know

Table of ContentsThe Best Strategy To Use For Retail Space For LeaseRetail Space For Lease - An OverviewExcitement About Retail Space For LeaseIndicators on Retail Space For Lease You Need To Know

Actual estate is among the earliest and also most popular property classes. Many brand-new investors in realty understand this, but what they don't recognize is the number of different types of genuine estate financial investments exist. As you uncover these different types of genuine estate investments and also find out even more about them, it isn't unusual to find a recommendation to a person that has developed a ton of money by finding out to concentrate on a certain specific niche.Basically all skilled actual estate capitalists utilize an LLC or a Limited Collaboration (LP). Developing an entity to hold your realty financial investments allows you to have an alternative to position that entity right into personal bankruptcy without risking your individual residential property as well as holdings. This method is called "possession separation" because it safeguards you and your holdings.

Business residential properties consist primarily of workplace buildings and high-rises. retail space for lease. If you were to take some of your cost savings and also construct a small building with individual workplaces, you could rent them out to firms and also little business proprietors, who would certainly pay you rent to use the residential or commercial property.

This can lead to higher security in cash circulation, and also even secure the proprietor when rental rates decline. One consideration is that markets do change, and rental rates might raise significantly over a short duration of time. It may not be feasible to raise rates if industrial property is locked into older contracts.

The smart Trick of Retail Space For Lease That Nobody is Discussing

As an example, an investor in California took several million bucks in savings and discovered a mid-size community in the Midwest - retail space for lease. He came close to a bank for financing and built a mixed-use three-story office complex bordered by retail shops. The financial institution, which offered him the cash, secured a lease on the very beginning, generating significant rental income for the proprietor.

Realty investment company, or REITs, are especially popular in the investment community. When you spend with a REIT, you are purchasing shares of a corporation that possesses property properties and also distributes practically every one of its earnings as dividends. There are tax complexitiesyour dividends aren't qualified for the low tax obligation prices you can hop on typical stocksbut official source they can be a good enhancement to your portfolio if bought at the appropriate worth, with a sufficient margin of safety.

g., hotel REITs. You can additionally get involved in more esoteric locations, such as tax obligation lien certifications. Technically, as lending money for genuine estate is thought about property investing, it can be thought about a fixed-income investment. This is comparable to a bond since you generate your financial investment return by offering money for interest revenue.

You are essentially financing a residential property, although this somewhat straddles the fence in between investing and financing. You will ultimately have the building, while its gratitude and also earnings belong to you.

The 2-Minute Rule for Retail Space For Lease

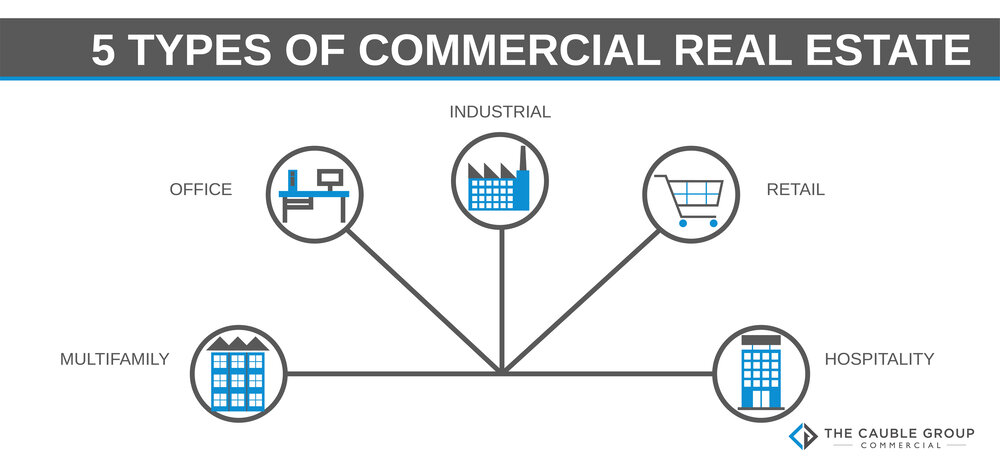

Source: (Shopify Allies/ Ruptured) Sorts of realty investments There are 4 major classifications of realty investing: Residential (structures that house individuals) Commercial (spaces in which businesses operate) Raw land (undeveloped building) Third-party (financial investments into crowdfunding deals, financial investment trust funds, and more) While several of the investment kinds we will enter can drop under more than one category, we're concentrating right here on domestic property investing.

Peer-to-peer borrowing If you're keen to begin purchasing genuine estate yet cash is restricted, know that it's feasible to attach $5,000 or less. Especially if you're interested in aiding others, peer-to-peer loaning can be a fascinating option. This design of investing entails putting your cash toward people or projects you actually rely on, such as aiding somebody to acquire a house or make significant fixings to a property.

, one more individual finance platform that makes it feasible to get begun in micro-investing with as little as $25.

Retail Space For Lease Things To Know Before You Buy

3. Realty investment company (REITs) You can check out a REIT as a means of niching down in property investing. A trust fund serves as a firm that concentrates on a particular kind of income-producing actual estate such as hotels, house structures, elderly real estate, and so forth. Just like a lot of financial investments, the even more money you can place in, the more you stand to acquire in the future, however REITs can be a possible path right into property investing for the daily customer.

Fix-and-flip houses If you have also moved here an obscure over here passion in property and also possess a tv, you have actually likely watched a show or two about flipping residences. The property is simple enough: Find a residence in demand of renovation, acquire it for a reduced rate, fix it up, make it look pretty, offer the building at an earnings.

6.